Planned Giving

Planned Gifts are a way for donors to leave a legacy for generations to come by contributing financially through gifts-in-kind, wills and bequests, charitable trusts, gifts of shares, gifts of life insurance and pension assets, gifts of RRSPs, RRIFs, and matching gifts. Legacy gifts help secure the future of Providence. We are excited about our plans to invest in our people, our programs and our places; to inspire a new generation of alumni and friends to join in empowering Providence to prepare people to live as difference makers in the church and the world.

Plan With Us

Our Development Team would be happy to connect with you and help you plan your estate gift to Providence. Consider creating and naming your own scholarship to support students, giving to a capital project that sees buildings being constructed or renovated, or giving support to Providence’s programs. Contact us using the information below with any questions you may have!

Future Generations

I am excited to see how the school is evolving and growing as there is a need for Christian education in Canada. My husband and I feel a strong call to support the school that gave us our own firm foundation and have included it in our estate planning. ~ Esther Dyck (Former Board Member, Alumna ’82)

Wills and Bequests

A charitable bequest is a gift to a charity through a will. A charitable bequest to Providence enables a donor to make a significant gift that they may not have been able to make during their lifetime. A charitable bequest to Providence can provide a tax credit up to 100% of the donor’s income in the year of the donor’s death and in the preceding year.

Example

Henry and Pamela have been supporters of Providence for many years and left a provision in their will to gift 15% of the estate’s residue to Providence. Henry passed away and left everything to Pamela in his will. Pamela subsequently passed away in 2016. In 2017, the residue was calculated to be $100,000, Pamela’s Executor transferred $15,000 from the estate to Providence and Providence issued a tax receipt for $15,000 that saved the estate $7,500 in taxes.

Gifts of Life Insurance

- You can purchase a new policy and name Providence as irrevocable owner and beneficiary (you would receive a yearly charitable donation receipt for the amount of premiums paid).

- You can donate an existing policy and name Providence as irrevocable owner and beneficiary (you would receive a charitable donation receipt for the net cash surrender value and for any subsequent premiums paid).

- You can make Providence the beneficiary of a new or existing donor owned policy by directing the death benefit to Providence (your estate receives a tax credit when the proceeds are realized).

Example

Bill and Mary have a $350,000 insurance policy that will pay the death benefit should either of them passed away. The purpose of the policy was to ensure that the survivor would have a mortgage free home and sufficient capital in the event that something happened to Bill or Mary before their children were grown. Now that both children have left the home and are married, Bill and Mary realize that the $2,500 annual premiums for the policy may no longer be a good use of their funds and are considering letting the policy lapse. Bill and Mary have always supported Providence and after meeting with Providence staff, they decided to donate their life insurance policy to Providence in exchange for a charitable tax receipt for $175,000 (net cash surrender value). Once told that premiums paid would be a gift to Providence and also eligible for a charitable tax receipt, they pledged to continue paying the $2,500 annual premium for as long as they could. The donation of the existing life insurance policy saved Bill and Mary $81,200 in taxes, and the ongoing annual donations of $2,500 save them $1,160 per year in tax. When either Bill or Mary pass away, Providence will receive $350,000 to use for its charitable work.

Gifts of Publically Traded Securities

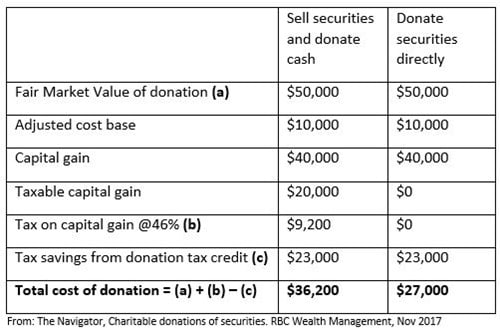

Donors can donate appreciated property (in-kind), like publicly traded securities (stocks, bonds, mutual funds, and options) to Providence and receive a charitable deduction for the full market value of the asset and pay no capital gains tax on the transfer. When securities are sold first, rather than donated in-kind, then a capital gain may be incurred reducing the available donation tax credit.

Example

John and Edith have $50,000 in securities (mutual funds) held in a non-registered account that were purchased for $10,000 (for this example Adjusted Cost Base = $10,000). They have been considering a gift of $50,000 to Providence in their estate. John and Edith can choose to liquidate all their assets to disburse funds from their estate, including the donation they plan to give to Providence, or they can donate the securities in-kind to Providence. The following table shows the difference between these choices in the actual cost of the donation:

Gifts of RRSPs and RRIFs

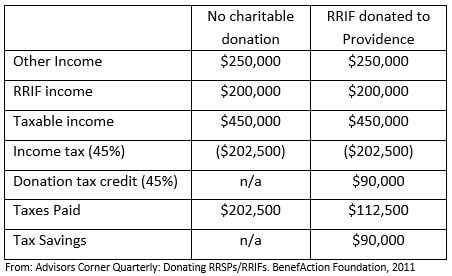

Retirement plan assets are one of the most heavily taxed estate assets to pass onto heirs. In some cases the funds can be taxed at over 50% when probate fees are added. Since 2000 it is possible to make a direct designation of an RRSP or RRIF to a charity (except in Quebec). This means that Providence can be made full or partial beneficiary of your RRSP or RRIF and upon death the assets will be paid directly to Providence and taxes avoided. The estate will receive a 100% tax credit claimable against net income in the final two tax years.

Example

Rudy and Jane would like to designate Providence as the beneficiary of their RRIF upon their passing. The following table shows the tax implications on their estate using the current value of their assets: